Common Trading Mistakes and How to Avoid Them

August 21, 2025

How to Use Leverage Safely in Crypto Trading

August 21, 2025Diving into the world of cryptocurrency can be exciting, overwhelming, and sometimes downright confusing. The fast-paced nature of crypto markets, combined with volatile price swings, can make beginners feel like they’re navigating a maze without a map. That’s why having a solid crypto trading plan is not just helpful—it’s essential for anyone looking to succeed.

In this guide, we’ll walk you through how to build your first crypto trading plan, step by step, with practical tips and examples that even beginners can follow. By the end, you’ll have a clear roadmap to start trading with confidence, discipline, and a strategy tailored to your goals.

Why You Need a Crypto Trading Plan

Imagine trying to travel to a new city without GPS or a map. You might get lucky, but chances are you’ll waste time, energy, and possibly money. Trading cryptocurrencies without a plan is similar—it’s easy to get lost in the noise of the market.

A trading plan helps you define your objectives, set rules for entry and exit, manage risk, and avoid emotional decision-making. Without it, even the most promising trades can turn into losses simply because of impulsive decisions or lack of strategy.

Step 1: Define Your Goals

The first step in creating your trading plan is defining your goals. Ask yourself:

- Am I trading to make short-term gains, or am I investing for long-term growth?

- How much time can I realistically dedicate to monitoring the market?

- What level of risk am I comfortable with?

For example, a beginner might start with a goal like:

“I want to grow my BTC holdings steadily over six months while limiting losses to 5% per trade.”

Clearly defined goals will guide your strategy, helping you choose the right trading style and instruments.

Step 2: Choose Your Trading Style

There are several trading styles, and your choice will depend on your goals, risk tolerance, and time commitment:

- Day Trading – Buying and selling within the same day to take advantage of short-term price movements. Requires constant monitoring.

- Swing Trading – Holding positions for several days or weeks to capture trends. Less intensive than day trading but requires understanding market trends.

- Position Trading / Long-Term Investing – Holding for months or years, focusing on long-term growth. Requires patience and less daily management.

For beginners, swing trading or position trading is often recommended, as it allows time to learn without the stress of day trading’s rapid pace.

Step 3: Select Your Cryptocurrencies

Not all cryptocurrencies are created equal. Bitcoin (BTC) is often the first choice for beginners due to its liquidity, stability, and market dominance. Other coins like Ethereum (ETH), Binance Coin (BNB), or Solana (SOL) can also be considered based on research.

A great way to start is by focusing on major pairs, such as BTC/USDT. You can check live prices and trade BTC/USDT on Exbix to understand market behavior and liquidity.

Step 4: Analyze the Market

Market analysis is crucial. There are two main approaches:

4.1 Technical Analysis (TA)

Technical analysis involves studying charts, patterns, and indicators to predict future price movements. Some popular tools for beginners include:

- Moving Averages (MA) – Helps identify trends.

- Relative Strength Index (RSI) – Indicates overbought or oversold conditions.

- Support and Resistance Levels – Show price points where a cryptocurrency tends to bounce or drop.

For example, if BTC/USDT approaches a strong support level and RSI shows it’s oversold, it might be a good entry point for a long trade. You can monitor these indicators directly on the Exbix BTC/USDT trading dashboard.

4.2 Fundamental Analysis (FA)

Fundamental analysis looks at the broader factors affecting a cryptocurrency’s value:

- News and updates about the blockchain project

- Adoption rates and partnerships

- Regulatory developments

- Technological upgrades and network activity

For instance, a major Bitcoin upgrade or adoption announcement can drive prices up, creating potential trading opportunities.

Step 5: Risk Management

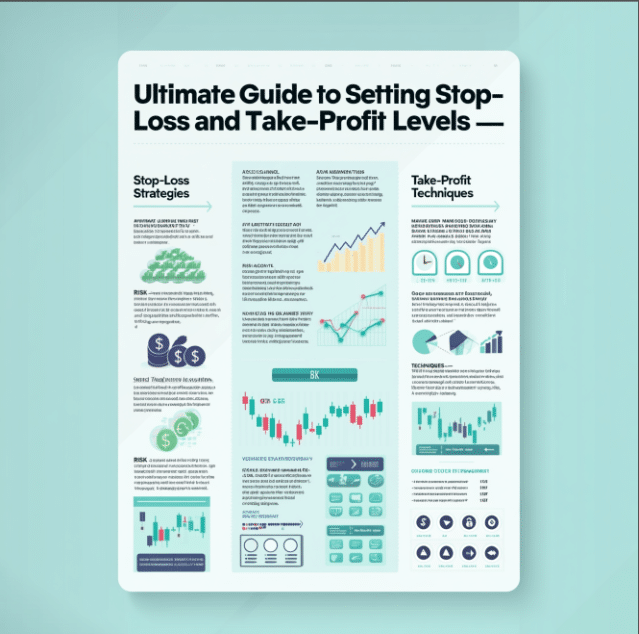

Risk management is the backbone of every trading plan. Here’s how beginners can protect their capital:

- Determine Your Risk per Trade – Never risk more than 1–2% of your total capital on a single trade.

- Set Stop-Loss Orders – Protect yourself from unexpected market swings. For example, if you buy BTC at $30,000, a stop-loss at $29,000 limits potential losses.

- Use Take-Profit Levels – Plan your exit strategy to lock in profits. For example, target $32,000 for BTC if the market is trending upward.

- Diversify – Avoid putting all your funds in a single cryptocurrency.

By following these rules, even beginners can survive the inevitable volatility of crypto markets.

Step 6: Develop a Trading Routine

Consistency is key. A good trading routine might include:

- Daily Review – Check market news, price charts, and open positions.

- Weekly Plan – Define new entry points, target profits, and stop-loss levels.

- Monthly Reflection – Review performance, learn from mistakes, and adjust your plan.

For example, you could check BTC/USDT prices on Exbix’s live dashboard every morning, identify potential trades, and update your strategy accordingly.

Step 7: Track Your Trades

Maintaining a trading journal is often overlooked but incredibly valuable. Record:

- Entry and exit points

- Trade size and direction

- Rationale for entering the trade

- Outcome and lessons learned

Over time, this data will reveal patterns in your behavior, strengths, and areas that need improvement.

Step 8: Keep Emotions in Check

Cryptocurrency trading can stir strong emotions: excitement during rallies, fear during drops. Emotional trading often leads to poor decisions.

Strategies to maintain discipline:

- Stick to your trading plan

- Avoid impulsive trades based on social media hype

- Use stop-losses and take-profits to automate decisions

- Accept losses as part of learning

Remember, even experienced traders lose sometimes. The key is to minimize emotional decisions and focus on long-term strategy.

Step 9: Continuously Learn and Adapt

Crypto markets are dynamic. New coins, technologies, and trends emerge constantly. To stay ahead:

- Follow reputable crypto news sources

- Join educational communities or forums

- Experiment with small trades to test new strategies

- Review and refine your trading plan regularly

The best traders evolve with the market—they’re always learning.

Step 10: Start Small and Scale Up

Begin with a small portion of your capital to minimize risk. For example, start trading $100–$200 to practice executing your plan and gaining confidence. Once you’re consistent and profitable, gradually increase your position size.

Using the BTC/USDT pair on Exbix is ideal for beginners—it’s highly liquid and easy to monitor.

Example Beginner Trading Plan

Here’s a simplified example of a beginner’s trading plan:

- Goal: Increase BTC holdings by 10% in 3 months.

- Trading Style: Swing trading with positions held 1–7 days.

- Cryptocurrencies: BTC/USDT, ETH/USDT.

- Entry Strategy: Buy BTC when RSI < 30 and price near support level.

- Exit Strategy: Take profit at 5–10% above entry; stop-loss at 3% below entry.

- Risk Management: Risk 2% of total capital per trade.

- Routine: Check charts every morning, update positions weekly, review trades monthly.

This plan is simple but covers all essential elements to trade responsibly as a beginner.

Common Beginner Mistakes to Avoid

Even with a plan, beginners often fall into traps:

- Overtrading – Trading too frequently can lead to losses and fees.

- Ignoring Risk Management – Not using stop-losses or over-leveraging is a fast track to losing money.

- Following the Crowd – Social media hype can be misleading. Always research before acting.

- Chasing Losses – Trying to recover losses quickly often results in bigger losses.

- Skipping Education – Lack of understanding about markets and tools leads to mistakes.

Avoiding these mistakes will save you from unnecessary setbacks.

Tools to Support Your Trading Plan

Several tools can help you implement your plan:

- Trading Platforms: Exbix provides a robust dashboard for monitoring pairs like BTC/USDT with real-time data.

- Charting Software: TradingView or built-in charts for technical analysis.

- Portfolio Trackers: Track your overall crypto holdings and performance.

- News Aggregators: Stay updated with market-moving news.

Using these tools can streamline your trading process and help you stay disciplined.

Final Thoughts

Building your first crypto trading plan might seem daunting, but breaking it down into these steps makes it manageable. Start with clear goals, define your strategy, manage risk, and stick to your routine. Remember, crypto trading is a marathon, not a sprint.

By focusing on discipline, continuous learning, and structured planning, you’ll improve your chances of success and gain confidence in navigating the dynamic world of cryptocurrency. Start small, practice, and scale up as you grow.

To get started right away, check out the BTC/USDT trading dashboard on Exbix and begin monitoring live market data. Remember, every successful trader once stood where you are today—as a beginner learning the ropes.