What is Staking in Cryptocurrency?

August 22, 2025

What Are NFTs and How Do They Work?

August 22, 2025In recent years, the financial world has experienced a groundbreaking transformation. Traditional banking and financial systems, which have operated for centuries, are now being challenged by a new paradigm: Decentralized Finance (DeFi). But what exactly is DeFi, and why is it generating so much excitement among investors, developers, and everyday users? In this post, we’ll break down everything you need to know about DeFi, its benefits, risks, and how it is reshaping the future of finance. For more insights and crypto trading opportunities, check out Exbix.

What is DeFi?

Decentralized Finance, or DeFi, refers to a financial ecosystem built on blockchain technology that operates without traditional intermediaries like banks, brokers, or payment processors. Instead, DeFi platforms leverage smart contracts—self-executing contracts with the terms of the agreement directly written into code—to facilitate financial transactions automatically. This system allows users to borrow, lend, trade, and earn interest on cryptocurrencies without relying on centralized authorities.

Unlike conventional financial services, where a bank or a financial institution controls the movement of your money, DeFi puts full control into the hands of users. This trustless environment ensures transparency, accessibility, and the elimination of many traditional financial barriers.

Key Features of DeFi

DeFi is characterized by several unique features that differentiate it from traditional finance:

- Decentralization: Transactions occur on a blockchain, eliminating the need for central authorities.

- Transparency: All activities and smart contract code are publicly accessible.

- Interoperability: DeFi platforms can integrate seamlessly with other protocols, creating a composable financial ecosystem.

- Permissionless Access: Anyone with an internet connection and a crypto wallet can participate, regardless of geographic location or financial status.

- Programmability: Smart contracts allow developers to create automated financial instruments.

These features collectively contribute to a financial system that is more inclusive, efficient, and innovative.

How DeFi Works

At the heart of DeFi are smart contracts deployed on blockchain networks like Ethereum, Binance Smart Chain, or Solana. These contracts automatically execute actions such as transferring funds, issuing loans, or distributing rewards according to predefined rules. Because smart contracts are immutable once deployed, they reduce human error, fraud, and reliance on intermediaries.

DeFi platforms typically offer a variety of services:

- Lending and Borrowing: Users can lend their cryptocurrencies to others in exchange for interest or borrow funds by providing collateral. For example, a user can deposit Ethereum into a lending platform and earn interest paid by borrowers. Popular DeFi lending platforms include Aave and Compound.

- Decentralized Exchanges (DEXs): Unlike centralized exchanges, DEXs allow users to trade directly from their wallets without depositing funds. Examples include Uniswap and SushiSwap.

- Yield Farming and Liquidity Mining: Users can stake their crypto assets in liquidity pools to earn rewards. This incentivizes liquidity and creates a vibrant ecosystem.

- Stablecoins: DeFi relies heavily on stablecoins—cryptocurrencies pegged to fiat currencies like USD—to provide price stability for transactions and lending.

By combining these services, DeFi offers an alternative financial system that is faster, cheaper, and more accessible than traditional banking.

Benefits of DeFi

DeFi offers several advantages that are driving its adoption:

- Financial Inclusion: Traditional financial systems exclude millions worldwide due to lack of documentation, credit history, or banking infrastructure. DeFi is permissionless, enabling anyone with a crypto wallet to participate.

- Lower Costs: By removing intermediaries, DeFi reduces fees associated with transactions, loans, and cross-border payments.

- Transparency and Security: All transactions are recorded on a public blockchain, providing auditability and reducing the potential for corruption or fraud.

- Innovative Financial Products: DeFi introduces new financial instruments like flash loans, synthetic assets, and algorithmic stablecoins that were not possible in traditional finance.

- Global Accessibility: Users from anywhere in the world can access DeFi services 24/7, bypassing banking hours and geographic restrictions.

For traders and crypto enthusiasts, DeFi also creates opportunities to earn passive income through staking, lending, and liquidity provision. Platforms like Exbix make it easier to explore these opportunities.

Risks and Challenges in DeFi

Despite its promising potential, DeFi is not without risks. Some of the main challenges include:

- Smart Contract Vulnerabilities: Bugs or flaws in smart contract code can lead to losses or hacks.

- Regulatory Uncertainty: Governments are still figuring out how to regulate DeFi, which can affect its long-term adoption.

- Market Volatility: Crypto assets are inherently volatile, which can impact lending, borrowing, and yield farming returns.

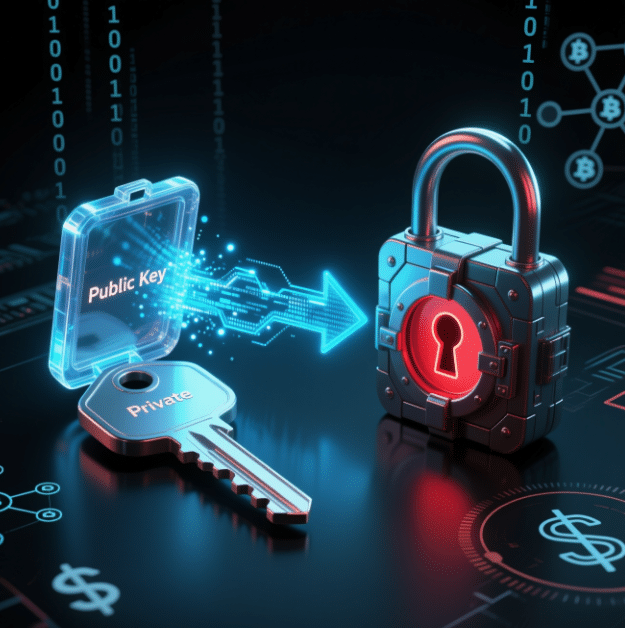

- User Error: Since users control their private keys, losing them can result in permanent loss of assets.

Understanding these risks is essential for anyone looking to participate in DeFi safely. Users should research platforms, understand smart contract risks, and use secure wallets.

Popular DeFi Platforms

Several DeFi platforms have gained prominence due to their innovation and user adoption:

- Uniswap: A leading decentralized exchange that allows users to swap tokens without a centralized intermediary.

- Aave: A lending platform that enables users to earn interest and borrow crypto assets.

- Compound: A decentralized lending protocol that automatically adjusts interest rates based on supply and demand.

- MakerDAO: A platform that issues the DAI stablecoin and allows users to generate loans using cryptocurrency as collateral.

- Curve Finance: Specializes in stablecoin trading with low slippage and efficient liquidity provision.

These platforms are constantly evolving, offering new services and financial products that push the boundaries of traditional finance.

The Future of DeFi

The future of DeFi looks promising. With ongoing advancements in blockchain technology, scalability solutions, and cross-chain interoperability, DeFi is poised to become a mainstream financial alternative. Analysts predict that DeFi could eventually rival traditional banking in terms of efficiency, accessibility, and innovation.

Moreover, DeFi has the potential to transform not just finance but also other industries. For example, tokenized real estate, decentralized insurance, and supply chain finance could all benefit from DeFi principles.

Getting Started with DeFi

If you’re ready to explore DeFi, here are a few steps to get started:

- Create a Crypto Wallet: Choose a wallet that supports DeFi tokens and assets, such as MetaMask or Trust Wallet.

- Acquire Cryptocurrency: Purchase ETH, BNB, or other relevant tokens on a platform like Exbix.

- Connect to DeFi Platforms: Link your wallet to DeFi applications to start trading, lending, or staking.

- Start Small: Test platforms with small amounts to understand the mechanics before committing larger sums.

- Stay Informed: DeFi is constantly evolving, so following news, tutorials, and official documentation is essential.

By following these steps, you can safely explore DeFi while minimizing risks.

Conclusion

DeFi represents a radical shift in the financial landscape, offering transparency, accessibility, and innovation that traditional finance struggles to match. From lending and borrowing to decentralized exchanges and yield farming, DeFi provides a comprehensive ecosystem for the modern financial world. However, it is essential to approach DeFi with caution, understanding both the opportunities and the risks involved.

Whether you’re a seasoned trader, an investor seeking passive income, or someone curious about the future of money, DeFi has something for everyone. By leveraging blockchain technology and smart contracts, it is reshaping finance as we know it and paving the way for a truly global, decentralized economy.

For a deeper dive into crypto markets and to start trading DeFi tokens, visit Exbix.