Bitcoin: The Pioneer of the Digital Currency Revolution

August 16, 2025

10 Essential Trading Strategies Every Crypto Trader Should Know

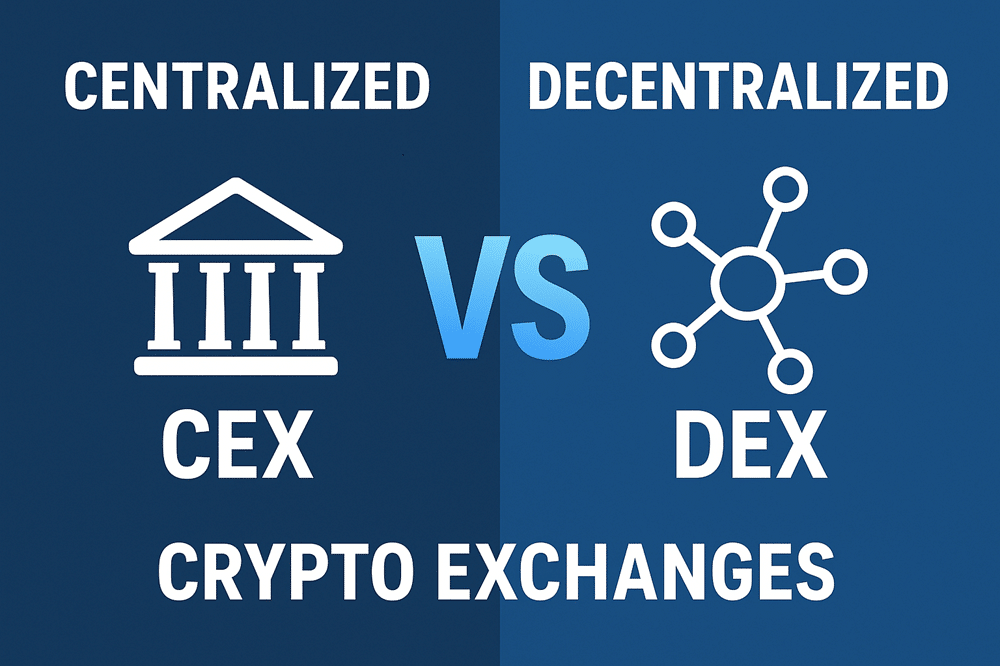

August 21, 2025Hey there, fellow crypto enthusiasts! If you’ve been dipping your toes into the world of cryptocurrencies, you’ve probably come across terms like CEX and DEX. These acronyms stand for Centralized Exchanges and Decentralized Exchanges, respectively, and they’re basically the gateways to trading digital assets like Bitcoin, Ethereum, and a whole bunch of altcoins. But what’s the big deal? Why does everyone keep debating which one’s better? Well, buckle up because in this post, we’re going to unpack the differences between CEX and DEX in detail. We’ll explore how they work, their pros and cons, real-world examples, and even touch on where the industry might be heading in 2025 and beyond. By the end, you’ll have a solid grasp to decide which type suits your trading style. Oh, and I’ll introduce you to a cool exchange called Exbix that blends some interesting features—more on that later.

Let’s start with the basics. Cryptocurrency exchanges are platforms where you can buy, sell, or trade digital currencies. Think of them as the stock markets of the crypto universe. The key difference between CEX and DEX boils down to control, security, and user experience. Centralized exchanges are run by companies or organizations that act as middlemen, handling your trades, holding your funds (temporarily), and ensuring everything runs smoothly. Decentralized exchanges, on the other hand, cut out the middleman entirely, letting users trade directly with each other via smart contracts on the blockchain. No bosses, no central servers—just pure peer-to-peer action.

This distinction isn’t just technical jargon; it affects everything from how secure your funds are to how fast you can execute a trade. In a world where crypto hacks make headlines and regulations are tightening, understanding these differences is crucial. According to recent reports, the global crypto exchange market is projected to hit over $100 billion by 2025, with DEXs gaining ground rapidly due to growing privacy concerns. But don’t worry, we’ll break it all down step by step. Whether you’re a newbie just buying your first Bitcoin or a seasoned trader flipping NFTs, this guide’s got you covered.

What is a Centralized Exchange (CEX)?

Alright, let’s kick things off with Centralized Exchanges, or CEXs. These are the big names you’ve probably heard of: Binance, Coinbase, Kraken, and the like. A CEX operates much like a traditional bank or stock exchange. There’s a central authority—a company—that manages the platform. When you sign up, you create an account, deposit your fiat money (like USD) or crypto, and start trading.

Here’s how it works under the hood: CEXs use an order book system. Buyers and sellers place orders (like “I want to buy 1 ETH at $2,500”), and the exchange matches them automatically. The platform holds your assets in its wallets during trades, which means you’re trusting them with your funds. This custodial model makes things super user-friendly. For instance, if you’re new to crypto, Coinbase has an intuitive app with educational resources, fiat on-ramps (easy ways to convert dollars to crypto), and even staking options where you can earn rewards on your holdings.

CEXs have been around since the early days of crypto. Bitcoin’s first major exchange, Mt. Gox, was a CEX (though it infamously got hacked in 2014, leading to massive losses). Today, they’re highly regulated in many countries. In the US, for example, exchanges like Gemini comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) rules, which means you have to verify your identity with ID documents. This regulation brings a sense of security but also adds bureaucracy.

One thing I love about CEXs is their liquidity. Liquidity means how easily you can buy or sell without affecting the price too much. On a busy CEX like Binance, which handles billions in daily volume, you can trade large amounts quickly. They also offer advanced features like margin trading (borrowing to amplify trades), futures contracts, and even crypto debit cards. Plus, customer support is usually top-notch—live chat, emails, and sometimes phone help if things go wrong.

But it’s not all sunshine. The centralization means a single point of failure. If the exchange gets hacked, your funds could be at risk. Remember the FTX collapse in 2022? It was a CEX that went belly-up due to mismanagement, wiping out billions. While most reputable CEXs now have insurance funds and cold storage (offline wallets) for security, the risk lingers. Fees can add up too—trading fees, withdrawal fees, and sometimes inactivity charges.

In 2025, CEXs are evolving with AI-driven tools for better trading signals and integration with Web3 wallets. They’re also pushing for more transparency post-FTX, with proof-of-reserves audits where they publicly show they hold enough assets to cover user deposits. If you’re someone who values convenience over absolute control, a CEX might be your go-to.

Pros and Cons of Centralized Exchanges

Now, let’s weigh the good and the bad of CEXs. Starting with the pros:

- Ease of Use: CEXs are beginner-friendly. Their interfaces are slick, like mobile apps with charts, news feeds, and one-click buys. No need to fiddle with wallets or gas fees right away.

- High Liquidity and Speed: As mentioned, trading volumes are massive. You can execute trades in seconds without slippage (price changes during the trade).

- Fiat Integration: Most CEXs let you deposit and withdraw traditional money via bank transfers, credit cards, or PayPal. This bridges the gap between crypto and everyday finance.

- Advanced Tools: From leverage trading to stop-loss orders, CEXs pack features that DEXs often lack. They also offer educational content and demo accounts.

- Customer Support and Regulation: Got an issue? Reach out to support. Plus, regulations mean better protection against fraud, and some even have insurance for hacks.

But every rose has its thorns. The cons include:

- Security Risks: Since the exchange holds your keys, “not your keys, not your crypto” rings true. Hacks happen—Binance was hit in 2019, though they covered losses.

- Privacy Concerns: KYC requirements mean sharing personal info, which could be leaked or used for surveillance.

- Censorship and Control: Governments can pressure CEXs to freeze accounts or delist coins. During geopolitical tensions, this has happened.

- Fees: While competitive, they eat into profits. Withdrawal fees for certain coins can be steep.

- Downtime: Centralized servers can go offline due to maintenance or attacks, halting trades at crucial times.

Overall, CEXs shine for active traders who prioritize speed and features but are willing to trust a third party.

What is a Decentralized Exchange (DEX)?

Shifting gears to Decentralized Exchanges, or DEXs. These are the rebels of the crypto world, embodying the original ethos of blockchain: decentralization, transparency, and user sovereignty. Popular DEXs include Uniswap, PancakeSwap, and SushiSwap, mostly built on blockchains like Ethereum, Binance Smart Chain, or Solana.

Unlike CEXs, DEXs don’t have a central boss. They run on smart contracts—self-executing code on the blockchain. When you trade, you’re swapping tokens directly from your wallet to another user’s via an Automated Market Maker (AMM) model. Instead of an order book, AMMs use liquidity pools where users deposit pairs of tokens (like ETH/USDT) and earn fees from trades.

Picture this: You connect your MetaMask wallet to Uniswap, select the tokens you want to swap, approve the transaction, and boom—it’s done on-chain. No account creation, no KYC, just your wallet address. This peer-to-peer setup means you always control your private keys and funds. DEXs emerged around 2017 with projects like EtherDelta, but exploded with DeFi (Decentralized Finance) in 2020.

In 2025, DEXs are more sophisticated. Layer-2 solutions like Arbitrum reduce Ethereum’s high gas fees, making trades cheaper and faster. Cross-chain DEXs let you swap assets across blockchains without bridges, reducing risks. Security-wise, since there’s no central honeypot of funds, large-scale hacks are rarer—though smart contract bugs can still bite, like the Ronin Network exploit in 2022.

DEXs also foster innovation. You can participate in yield farming (lending assets for rewards), liquidity mining, or even create your own tokens. They’re censorship-resistant; no government can easily shut them down because they’re distributed across nodes worldwide. If you’re into privacy and the “be your own bank” vibe, DEXs are empowering.

However, they’re not perfect for everyone. The learning curve is steeper—you need to manage your wallet, understand gas fees, and avoid scams like rug pulls (when developers abandon a project after raising funds).

Pros and Cons of Decentralized Exchanges

DEXs have a lot going for them, especially in a privacy-focused era. Here’s the upside:

- True Ownership: You hold your keys, so funds are safer from exchange failures. No more “FTX moments.”

- Privacy and Anonymity: No KYC means you trade without revealing your identity, appealing to those wary of big brother.

- Censorship Resistance: DEXs can’t be easily regulated or shut down. They’re ideal in countries with crypto bans.

- Global Accessibility: Anyone with internet and a wallet can use them, no bank account required.

- Innovation and Rewards: Earn yields by providing liquidity. Some DEXs offer governance tokens, letting users vote on platform changes.

But there are trade-offs:

- User Experience: Interfaces can be clunky for beginners. Wallet connections, transaction approvals, and fee estimations take time.

- Lower Liquidity: Compared to CEXs, DEXs have less volume, leading to slippage on big trades.

- Higher Fees and Slower Speeds: Blockchain gas fees fluctuate—Ethereum spikes can make a simple swap cost $50. Transactions aren’t instant.

- Smart Contract Risks: Bugs or exploits can drain pools. Audits help, but nothing’s foolproof.

- No Fiat Support: Most DEXs are crypto-only, so you need to on-ramp via a CEX first. No customer support either—if you send to the wrong address, it’s gone.

In essence, DEXs appeal to purists and advanced users who value decentralization over convenience.

Direct Comparison: CEX vs. DEX Head-to-Head

To make this crystal clear, let’s compare CEX and DEX across key categories. I’ll use a table for quick reference, then dive deeper.

| Aspect | CEX (Centralized) | DEX (Decentralized) |

|---|---|---|

| Control | Exchange holds funds; custodial | User controls funds; non-custodial |

| Security | Vulnerable to hacks but insured often | Safer from hacks, but smart contract risks |

| Privacy | Requires KYC; less private | No KYC; high privacy |

| Liquidity | High; fast trades | Lower; potential slippage |

| Fees | Fixed trading fees; withdrawal charges | Gas fees; variable |

| Speed | Instant matching | Depends on blockchain; can be slow |

| User-Friendliness | Easy for beginners; apps and support | Steeper curve; wallet required |

| Regulation | Compliant; fiat support | Less regulated; crypto-only mostly |

| Innovation | Advanced trading tools | DeFi features like farming |

Diving in: On security, CEXs have seen major breaches, but DEXs aren’t immune—exploits like the 2024 Curve Finance hack showed vulnerabilities in code. Privacy is a big win for DEXs; in an age of data breaches, not handing over your passport is huge.

Liquidity is where CEXs dominate. In March 2025, Binance alone handled $588 billion in volume, dwarfing DEXs. But DEXs are catching up with aggregators like 1inch that scan multiple pools for best rates.

Fees? CEXs charge 0.1-0.5% per trade, plus extras. DEXs’ gas fees dropped in 2025 thanks to Ethereum’s Dencun upgrade, but they still vary.

For speed, CEXs win hands-down—no waiting for block confirmations. User-friendliness favors CEXs too; imagine explaining wallet seeds to your grandma.

Regulation is double-edged. CEXs’ compliance builds trust but invites oversight. DEXs’ resistance appeals to libertarians but scares off institutions.

Ultimately, the choice depends on your needs. Day traders might stick with CEXs for tools, while long-term holders prefer DEXs for self-custody. Many users hybridize—use CEX for entry, then move to DEX for privacy.

Real-world example: During the 2022 crypto winter, CEX users panicked over withdrawals, while DEX traders swapped freely. But in bull markets, CEXs’ leverage options amplify gains (and losses).

Future Trends in CEX and DEX for 2025 and Beyond

Looking ahead, the lines between CEX and DEX are blurring. Hybrid models are emerging—think “CeDeX” where centralized interfaces meet decentralized backends. By 2025, expect more DEXs with fiat gateways via partnerships.

Regulation will shape things. The EU’s MiCA framework is pushing CEXs toward transparency, while DEXs might face DEX-specific rules on AML. Privacy tech like zero-knowledge proofs (used in DEXs like zkSync) will boom, letting users prove trades without revealing details.

Liquidity on DEXs is surging—Uniswap’s volume hit $1 trillion in 2024. AI integration could predict fees or optimize swaps. Sustainability is key too; energy-efficient blockchains like Solana are boosting DEX adoption.

Challenges remain: Scalability for DEXs (Ethereum layer-2s help), and trust rebuilding for CEXs post-scandals. Overall, the market’s maturing, with room for both.

Introducing Exbix Exchange

In the midst of this CEX vs. DEX debate, I want to spotlight a promising player: Exbix Exchange. Exbix is a user-centric cryptocurrency exchange that’s designed to make trading accessible and secure for everyone, whether you’re a beginner or pro. From what I’ve seen, it offers a blend of features that could appeal to those seeking the best of both worlds—though it’s worth noting it’s positioned as a centralized platform with strong emphasis on innovation.

Key highlights include intuitive trading interfaces, support for a wide range of cryptocurrencies, and competitive fees. They prioritize security with advanced measures like multi-factor authentication and cold storage. Plus, Exbix has educational resources to help newcomers navigate the crypto space. If you’re looking for a reliable spot to start or expand your portfolio, check them out at https://exbix.com/. It’s always smart to do your own research, but Exbix seems geared toward bridging traditional finance with crypto seamlessly.

Conclusion

Whew, we’ve covered a lot! From the controlled convenience of CEXs to the autonomous freedom of DEXs, the choice boils down to your priorities: speed and ease vs. privacy and control. In 2025, with crypto adoption skyrocketing, using both might be the way forward—buy on a CEX, trade on a DEX.

Remember, crypto is volatile; always invest what you can afford to lose and secure your assets. If you’re intrigued by Exbix, head over to https://exbix.com/ and see if it fits your needs. What’s your take? Are you team CEX, DEX, or hybrid? Drop your thoughts below—I’d love to hear!