Top 5 DeFi Innovations Reshaping the Financial Landscape in 2025

August 24, 2025

The Rise of Layer 2 Solutions: Scaling DeFi for Mass Adoption

August 24, 2025The world of Decentralized Finance (DeFi) has exploded onto the financial scene, promising a new paradigm where you are your own bank. At the heart of this revolution lies a concept that has captivated, confused, and made millionaires out of many: Yield Farming.

You might have heard the term thrown around, often accompanied by intimidating phrases like “liquidity pools,” “APY,” and “impermanent loss.” It can sound like a secret club for crypto-whisperers and math wizards. But what if we told you that the core idea is something humans have understood for centuries? It’s simply about putting your assets to work to generate more assets.

This ultimate guide is designed to demystify yield farming. We’ll break it down into simple, human-friendly language, explore the incredible opportunities and very real dangers, and equip you with strategies to navigate this exciting frontier. Whether you’re a curious beginner or a seasoned crypto enthusiast looking to refine your approach, this article is for you.

Table of Contents

- What is Yield Farming? (Beyond the Jargon)

- The Engine Room: How Yield Farming Actually Works

- Liquidity Pools (LPs): The Building Blocks

- Liquidity Providers (LPs): The Farmers

- The Role of Automated Market Makers (AMMs)

- The Seeds of Reward: Where Does the Yield Come From?

- Trading Fees

- Governance Tokens

- Other Incentive Mechanisms

- The Thorns on the Rose: A Deep Dive into the Risks

- Impermanent Loss (The Biggest Risk)

- Smart Contract Risks

- Rug Pulls and Scams

- Gas Fees

- Governance Token Volatility

- Cultivating Your Strategy: From Beginner to DeFi Degens

- Strategy 1: Stablecoin Farming (The Safe Haven)

- Strategy 2: Blue-Chip Pair Farming (The Balanced Approach)

- Strategy 3: The Full DeGen Experience (High-Risk, High-Reward)

- A Step-by-Step Guide to Your First Yield Farm

- The Future of Yield Farming: What’s Next?

- Conclusion: Is Yield Farming Right for You?

1. What is Yield Farming? (Beyond the Jargon)

At its simplest, yield farming is the practice of locking up your cryptocurrencies in a decentralized finance (DeFi) protocol to generate high returns or rewards in the form of additional cryptocurrency.

Think of it like a high-tech, decentralized version of earning interest in a savings account. But instead of a bank lending out your money and giving you a tiny 0.5% APY, you are providing your digital assets directly to a financial protocol (like a lending service or a decentralized exchange) and earning a significantly higher return, often ranging from 5% to triple-digit APYs.

The key difference? There is no bank. The entire process is automated by “smart contracts” – self-executing code on a blockchain. This eliminates the middleman but also places the responsibility for security and due diligence squarely on your shoulders.

2. The Engine Room: How Yield Farming Actually Works

To understand farming, you need to understand the machinery that makes it possible.

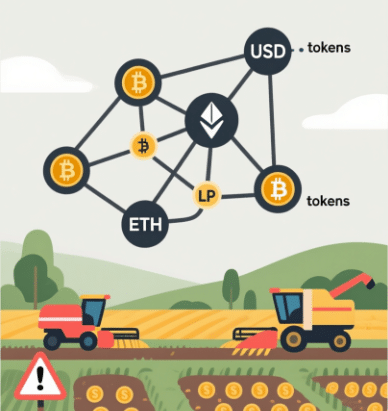

Liquidity Pools (LPs): The Building Blocks

A liquidity pool is a giant, shared pot of cryptocurrencies locked in a smart contract. These pools power decentralized exchanges (DEXs) like Uniswap or PancakeSwap. They allow users to trade assets without a traditional order book. Instead of matching a buyer with a seller, trades are executed directly against the funds in the liquidity pool.

For example, if you want to trade TRON (TRX) for Tether (USDT) on a DEX, you don’t wait for a seller. You interact with the TRX/USDT liquidity pool. You put your TRX in and take USDT out, with the exchange rate determined by a mathematical formula.

Liquidity Providers (LPs): The Farmers

This is where you come in. Liquidity Providers (LPs) are the individuals who deposit their crypto assets into these pools. By doing so, they are essentially providing the fuel that allows the entire decentralized exchange to run. In return for this service, they earn a reward.

The Role of Automated Market Makers (AMMs)

An AMM is the algorithm that makes it all work. It automatically sets and adjusts the price of the assets in a pool based on a mathematical formula (usually the Constant Product Formula: x * y = k). This ensures there is always a market and liquidity for traders, and it calculates the fees that are distributed to the LPs.

3. The Seeds of Reward: Where Does the Yield Come From?

Those astronomical APY percentages have to come from somewhere. Here are the primary sources:

- Trading Fees: This is the most straightforward reward. Every time a trader uses a pool you’ve contributed to to swap tokens, they pay a small fee (e.g., 0.25%). This fee is then distributed proportionally to all the liquidity providers in that pool. The more trading volume a pool has, the more fees you earn.

- Governance Tokens: This is where things get interesting. To bootstrap liquidity and attract farmers, new DeFi protocols often distribute their own native governance tokens as an extra reward. You might be farming fees in a TRX/USDT pool, but you’re also earning a brand new token like “XYZ” on the side. These tokens can be extremely valuable if the project takes off, but they can also be highly volatile or become worthless.

- Other Incentives: Some protocols offer additional rewards like a share of the platform’s revenue or incentives for performing specific actions like borrowing or staking.

4. The Thorns on the Rose: A Deep Dive into the Risks

Yield farming is not a guaranteed path to riches. The high rewards exist to compensate for the high risks. Ignoring these is the fastest way to get rekt.

- Impermanent Loss (The Biggest Risk): This is the most unique and misunderstood concept in yield farming. Impermanent loss occurs when the price of your deposited assets changes compared to when you deposited them. The greater the change, the more you are exposed to loss versus simply holding your assets.

- Why it happens: The AMM algorithm needs to rebalance the pool to maintain its formula. If the price of ETH skyrockets while you have ETH and USDT in a pool, the algorithm will automatically sell some of your ETH for USDT to keep the value balanced. You end up with less of the winning asset and more of the losing one.

- It becomes “permanent” when you withdraw. The loss is “impermanent” only on paper until you exit the position. For pairs with high volatility, this loss can easily outweigh any farming rewards you earned. This is why many farmers stick to stablecoin pairs (e.g., USDT/USDC) or pairs of pegged assets (like wBTC/BTC), where the risk of impermanent loss is minimal.

- Smart Contract Risks: You are entrusting your funds to lines of code. That code can have bugs or vulnerabilities that hackers can exploit. Millions of dollars have been lost to sophisticated hacks and exploits. Always research a protocol’s audit history (but remember, an audit is not a guarantee of safety).

- Rug Pulls and Scams: The DeFi wild west is full of malicious actors. A “rug pull” is when the developers of a project abandon it and run away with all the funds in the liquidity pool. This is especially common with anonymous teams and new, unaudited protocols offering impossibly high yields.

- Gas Fees: Operating on the Ethereum network (and others) requires paying transaction fees called “gas.” Complicated farming strategies involving multiple deposits, swaps, and claims can incur hundreds of dollars in fees. This can completely erase profits for smaller farmers.

- Governance Token Volatility: The sexy 1000% APY might be paid in a token that plummets 90% in value the next week. You need to constantly manage and often sell these reward tokens to realize actual profit.

5. Cultivating Your Strategy: From Beginner to DeFi Degens

Your strategy should align directly with your risk tolerance.

- Strategy 1: Stablecoin Farming (The Safe Haven)

- What it is: Providing liquidity for a pair of stablecoins, e.g., USDT/USDC.

- Risk/Reward: Lowest risk of impermanent loss, lower but steadier rewards (typically 5-15% APY). The main risk is the failure of a stablecoin itself (e.g., if USDC were to depeg).

- Who it’s for: Absolute beginners and risk-averse investors looking for better returns than traditional finance.

- Strategy 2: Blue-Chip Pair Farming (The Balanced Approach)

- What it is: Providing liquidity for a pair of established, high-market-cap cryptocurrencies. Think of pairs like ETH/USDT, BTC/USDT, or other major assets. You can explore pairs like ETC/USDT or PAXG/USDT (a gold-backed token) for different exposures.

- Risk/Reward: Moderate risk of impermanent loss, moderate rewards. You’re betting that the two assets won’t diverge in price dramatically. The yields are higher than stablecoin pools due to higher volatility and trading volume.

- Who it’s for: Investors comfortable with some risk who believe in the long-term value of both assets in the pair.

- Strategy 3: The Full DeGen Experience (High-Risk, High-Reward)

- What it is: Farming on new, unaudited protocols or providing liquidity for highly volatile and correlated assets (e.g., two obscure meme coins).

- Risk/Reward: Extremely high risk of impermanent loss, smart contract exploits, and rug pulls. The APYs can be in the thousands of percent, but you are essentially gambling.

- Who it’s for: Experienced DeFi users with a high risk tolerance who can afford to lose their entire investment. This is not for beginners.

6. A Step-by-Step Guide to Your First Yield Farm

- Get a Wallet: Set up a non-custodial wallet like MetaMask or Trust Wallet.

- Fund Your Wallet: Purchase cryptocurrency from a reputable exchange. If you’re looking for a secure and user-friendly platform to acquire your initial crypto, you can buy ETH, USDT, TRX, or other assets on Exbix. Once purchased, withdraw it to your personal wallet address.

- Choose Your Protocol and Pool: Start simple. Choose a well-established protocol like Uniswap (Ethereum) or PancakeSwap (Binanace Smart Chain) and a stablecoin or blue-chip pool.

- Provide Liquidity: Navigate to the “Pool” section, select the two assets you want to supply in equal USD values, and approve the transaction. You will receive LP Tokens representing your share of the pool.

- Stake Your LP Tokens: Often, you need to take your LP tokens to a separate “Farm” section to stake them and start earning the extra incentive rewards. Approve another transaction.

- Harvest and Manage: You can periodically “harvest” your reward tokens and either compound them (re-invest them) or swap them for stablecoins to secure profits.

7. The Future of Yield Farming

Yield farming is evolving. We’re seeing a move towards:

- Layer 2 Solutions: Protocols on networks like Polygon and Arbitrum are drastically reducing gas fees, making farming accessible to more people.

- Improved Risk Management: New insurance protocols like Nexus Mutual are offering coverage against smart contract failure.

- Cross-Chain Farming: Allowing farmers to move assets between different blockchains to chase the best yields.

- Simplified User Experiences: “Yield Aggregators” like Yearn.finance automate the process, moving your funds between strategies to maximize returns.

8. Conclusion: Is Yield Farming Right for You?

Yield farming is a powerful tool that democratizes access to financial services and offers unprecedented earning potential. However, it is not a free money glitch. It is a complex, high-risk activity that requires deep research, constant monitoring, and a strong stomach for volatility.

Start small, start safe, and never invest more than you are willing to lose. Master stablecoin pools before you even think about the high-risk farms. The DeFi landscape is thrilling, but it pays to be a cautious farmer. Do your own research, understand the risks, and may your yields be high and your losses impermanent.

Ready to explore the world of crypto? Start by securely acquiring your first assets on a trusted platform. Sign up for an Exbix account today to begin your journey into the world of digital currencies and DeFi.