Mastering Crypto Trading: A Comprehensive Guide for Beginners

Introduction to Cryptocurrency Trading

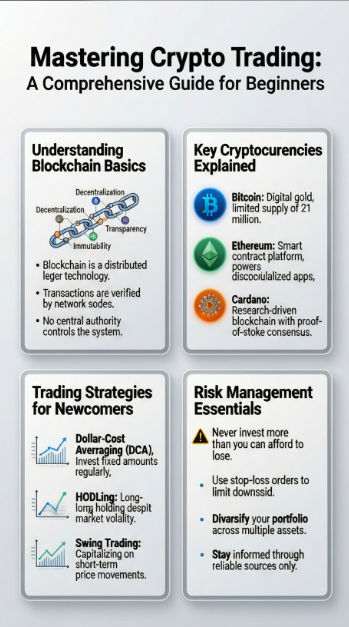

Cryptocurrency trading has garnered significant attention in recent years, transforming from a niche market into a global phenomenon. With the proliferation of digital currencies such as Bitcoin, Ethereum, and countless altcoins, traders are presented with a unique opportunity to capitalize on the volatility and potential growth of these assets. However, entering the cryptocurrency market can be daunting for beginners, given the complexity and rapid pace of this evolving landscape.

At its core, cryptocurrency trading involves buying and selling digital currencies in order to make a profit. This process can take various forms, including spot trading, futures trading, and margin trading, each with its own risks and rewards. Spot trading, for instance, involves the immediate purchase or sale of a cryptocurrency, while futures trading allows traders to speculate on the future price movements of a currency without actually owning it. Understanding these different trading methodologies is crucial for beginners looking to navigate the crypto space effectively.

One of the defining features of cryptocurrency trading is its 24/7 nature. Unlike traditional stock markets that operate on fixed hours, cryptocurrency markets are always open, providing traders with the flexibility to execute trades at any time. This continuous operation can lead to significant price fluctuations, creating both opportunities and risks. As a beginner, it's essential to stay informed about market trends, news, and events that could impact the prices of various cryptocurrencies. Utilizing tools such as price charts, trading indicators, and news aggregators can help you make more informed trading decisions.

Additionally, risk management is a critical aspect of successful trading. The volatile nature of cryptocurrencies means that prices can swing dramatically in short periods, which can result in substantial gains or losses. For this reason, developing a robust trading strategy that incorporates risk management techniques is vital. This may involve setting stop-loss orders, diversifying your portfolio, and only investing what you can afford to lose. By approaching cryptocurrency trading with a well-structured plan and a clear understanding of the market, beginners can position themselves for success in this exciting and dynamic environment.

Understanding Market Trends and Indicators

In the world of crypto trading, understanding market trends and indicators is crucial for making informed decisions. Market trends refer to the general direction in which the price of a cryptocurrency is moving over a certain period. These trends can be classified into three main types: uptrends, downtrends, and sideways trends. An uptrend is characterized by higher highs and higher lows, indicating that the market is experiencing an overall increase in price. Conversely, a downtrend features lower highs and lower lows, signifying a decline in market value. Sideways trends occur when the price moves within a horizontal range, suggesting market indecision.

Additionally, traders use various technical indicators to analyze market trends and predict future price movements. Some of the most popular indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands. Moving averages help smooth out price action and provide insight into the overall trend direction by averaging the price over a specific time frame. The RSI, on the other hand, measures the speed and change of price movements, indicating whether a cryptocurrency is overbought or oversold, helping traders identify potential reversal points.

Bollinger Bands consist of a middle band (the moving average) and two outer bands that represent standard deviations from the moving average. This tool is particularly useful for identifying volatility; when the bands expand, it indicates increased volatility, while a contraction suggests reduced volatility. By combining these indicators, traders can gain a comprehensive view of market conditions and make more informed trading decisions.

It's essential for beginners to not only learn how to read these indicators but also to practice interpreting them in real-time market conditions. Using demo accounts or paper trading can help newcomers test their understanding without risking real money. Understanding market trends and indicators lays the foundation for developing effective trading strategies, allowing traders to navigate the often volatile landscape of cryptocurrency trading with greater confidence.

Choosing the Right Trading Platform

When diving into the world of cryptocurrency trading, one of the most critical steps you’ll take is selecting the right trading platform. The platform you choose can significantly impact your trading experience, from the user interface to the range of cryptocurrencies available for trading. Therefore, it’s essential to consider various factors to ensure that you make an informed decision that aligns with your trading goals.

First and foremost, security should be your top priority. Look for platforms that offer features such as two-factor authentication (2FA), cold storage for funds, and a transparent security history. Unfortunately, the cryptocurrency space has seen its fair share of hacks and scams, so opting for a platform with a solid reputation and robust security measures can help protect your assets. Additionally, check if the platform complies with local regulations and is registered with relevant financial authorities, as this can offer an extra layer of safety.

User experience is another vital aspect to consider. A good trading platform should have an intuitive interface that caters to both beginners and experienced traders. If you’re just starting, you may want to choose a platform that offers educational resources, such as tutorials and market analyses, to help you understand trading concepts better. Moreover, consider the availability of customer support. Having access to reliable support can be invaluable, especially if you encounter issues or have questions while trading.

Another crucial factor is the range of cryptocurrencies offered. While Bitcoin and Ethereum may dominate the headlines, the crypto market is vast, with thousands of altcoins available. If you’re interested in diversifying your portfolio, look for a platform that provides access to a wide variety of cryptocurrencies. Additionally, consider the trading fees associated with the platform. Different platforms have different fee structures, including transaction fees, withdrawal fees, and trading fees, which can impact your overall profitability. Always read the fine print and calculate how these fees could affect your trading strategy.

Fundamental vs. Technical Analysis

In the world of crypto trading, understanding the difference between fundamental and technical analysis is crucial for making informed decisions. Both methods serve as valuable tools for traders, yet they focus on distinct aspects of the market. Fundamental analysis involves evaluating the intrinsic value of a cryptocurrency by examining various factors that can influence its price, such as the technology behind the coin, its use case, the team involved, market demand, and economic conditions. This type of analysis often requires a deeper understanding of the crypto project, including its whitepaper, roadmap, and community engagement.

On the other hand, technical analysis is centered around price movements and trading volume. It relies on historical price data and various charting tools to identify patterns and trends that can help predict future price behavior. Traders who use technical analysis often employ indicators such as moving averages, support and resistance levels, and volume analysis. By studying these patterns, traders can make educated guesses about when to enter or exit a trade, regardless of the underlying fundamentals of the asset.

While both fundamental and technical analysis have their merits, the best approach often lies in combining the two. For instance, a trader might use fundamental analysis to identify a cryptocurrency with strong long-term potential, while leveraging technical analysis to determine the optimal entry and exit points. This hybrid strategy allows traders to capitalize on market movements while remaining aware of the underlying factors that could impact the asset's value over time.

Ultimately, mastering crypto trading requires a balanced understanding of both analyses. Beginners should take the time to familiarize themselves with key concepts in each area. By doing so, they can develop a comprehensive trading strategy that not only considers price trends but also the fundamental factors driving those trends. As the crypto market continues to evolve, having a solid grasp of both fundamental and technical analysis will empower traders to make informed decisions and adapt their strategies to changing market conditions.

Developing a Trading Strategy

Creating a successful trading strategy is essential for any aspiring crypto trader. A well-defined strategy not only helps you navigate the volatile nature of cryptocurrency markets but also minimizes emotional decision-making, which can lead to poor trading outcomes. To develop a trading strategy, begin by assessing your investment goals, risk tolerance, and time commitment. Determine whether you are looking for short-term gains through day trading or long-term investment through holding assets. Each approach requires a different strategy and mindset.

Once you have a clear understanding of your goals, it is crucial to conduct thorough research on the cryptocurrencies you are interested in. Analyze market trends, historical price movements, and the underlying technology of each asset. This research will help you identify potential entry and exit points, giving you the ability to make informed decisions. Additionally, consider incorporating technical analysis tools, such as moving averages and Relative Strength Index (RSI), to better gauge market conditions and identify potential trading opportunities.

Risk management is another vital component of a solid trading strategy. Decide in advance how much capital you are willing to risk on each trade and set stop-loss orders to protect your investments from significant losses. A common rule of thumb is to risk no more than 1-2% of your trading capital on a single trade. By managing your risk effectively, you can sustain your trading activities over the long term and avoid emotional reactions to market fluctuations.

Finally, keep a trading journal to track your trades, strategies, and outcomes. Documenting your decisions and the results will allow you to reflect on your successes and failures, helping you refine your strategy over time. Trading is a continuous learning process, and adapting your strategy based on past experiences will ultimately lead to improved performance. Remember, there is no one-size-fits-all approach to trading; what works for one trader may not work for another. Stay flexible, be patient, and continuously educate yourself to maximize your trading potential.

Risk Management in Crypto Trading

Risk management is a crucial aspect of crypto trading that every trader, especially beginners, must understand and implement. The volatile nature of cryptocurrencies means that prices can swing dramatically in a very short period, which can lead to substantial gains or devastating losses. To navigate this landscape successfully, traders need to adopt robust risk management strategies that allow them to protect their capital while maximizing potential returns.

One of the first principles of risk management is setting a clear risk-reward ratio for each trade. This ratio helps determine how much you are willing to risk in pursuit of a potential reward. A common guideline is to aim for a minimum risk-reward ratio of 1:2, meaning that for every dollar you risk, you should aim to make at least two dollars. By establishing this ratio before entering a trade, you can make more informed decisions and avoid emotional trading, which often leads to poor outcomes.

Another critical component of risk management is the use of stop-loss orders. A stop-loss order is a predetermined price at which you will exit a trade to prevent further losses. Setting a stop-loss helps limit your exposure to unfavorable market movements. It’s important to place the stop-loss at a level that reflects your risk tolerance and the volatility of the specific cryptocurrency you are trading. However, placing it too close to the market price can result in premature exits, while placing it too far away can expose you to larger losses.

Diversification is another strategy that can significantly mitigate risk in crypto trading. By spreading your investments across different cryptocurrencies or even other asset classes, you can reduce the impact of a poor-performing asset on your overall portfolio. This approach helps balance risk and can lead to more stable returns over time. However, keep in mind that diversification should be done thoughtfully; investing in too many assets can lead to confusion and diluted focus. Ultimately, mastering risk management in crypto trading is about finding the right balance between risk and reward, enabling you to trade confidently and sustainably in this highly dynamic market.

Executing Trades: A Step-by-Step Process

Once you've done your research and chosen the right cryptocurrency to trade, the next key step is executing your trades effectively. This process might seem daunting at first, but with a structured approach, you'll find it manageable. Whether you're using a centralized exchange or a decentralized platform, the fundamental steps remain largely the same. Let's break down the process into clear, actionable steps.

First, you need to set up your trading account. This involves selecting a reputable cryptocurrency exchange that aligns with your trading goals, whether you're looking for low fees, a diverse selection of coins, or advanced trading tools. After choosing an exchange, you'll need to complete the registration process, which typically includes providing your email address, creating a password, and verifying your identity. Once your account is verified, deposit funds into your account. Most exchanges accept various payment methods, including bank transfers, credit/debit cards, and sometimes even PayPal.

After your account is funded, it's time to navigate to the trading interface. Here, you will find various options, including market orders, limit orders, and stop orders. A market order allows you to buy or sell a cryptocurrency at the current market price, while a limit order lets you set a specific price at which you want to buy or sell. Understanding these order types is crucial, as they can significantly impact your trading strategy and outcomes. For beginners, starting with market orders can simplify the process, while more experienced traders often use limit orders to maximize their entry and exit points.

Finally, before executing your trade, double-check all the details, including the amount, price, and order type. Once you're confident in your decision, click the 'buy' or 'sell' button to execute your trade. After the trade is executed, monitor your position closely, and consider using take-profit and stop-loss orders to manage your risk effectively. By following these steps, you'll be well on your way to executing trades like a seasoned trader.

Conclusion and Next Steps

As we conclude this comprehensive guide on mastering crypto trading, it's crucial to reflect on the key takeaways that can help you navigate this exciting yet volatile market. Understanding the fundamentals of cryptocurrency, the various trading strategies, and the psychological aspects of trading are vital components that will set the foundation for your success. Remember that crypto trading is not just about making quick profits; it is a long-term commitment that requires continual learning and adaptation to changing market conditions.

With the knowledge you've gained, the next step is to put theory into practice. Start by creating a demo trading account to test your strategies without risking real money. This will give you valuable hands-on experience and help you develop your trading skills in a risk-free environment. Pay attention to your trading journal, where you can record your trades, reflect on your decisions, and learn from your mistakes. This practice will enhance your decision-making abilities and contribute to your growth as a trader.

Furthermore, stay informed about the latest developments in the crypto space. The cryptocurrency market is constantly evolving, with new projects, regulations, and technologies emerging regularly. Following credible news sources, joining online communities, and participating in forums can provide you with insights and perspectives that are crucial for making informed trading decisions. Networking with other traders and sharing experiences can also enrich your understanding of the market.

Lastly, always remember to manage your risk effectively. Use stop-loss orders to protect your investments and ensure that you never risk more than you can afford to lose. By developing a solid risk management strategy and sticking to it, you can trade with confidence and reduce the emotional stress that often accompanies trading. Embrace the journey, and with dedication and patience, you will become a proficient crypto trader.